#GEMINI EXCHANGE VS COINBASE SOFTWARE#

Third-party integrations: Gemini provides public API keys so you may connect other software tools, making Gemini a wonderful option for fund managers or other institutional traders.Currently, Gemini Dollar earns the best annual percentage yield (APY) at 8.05%. The Gemini Earn program: Customers in all 50 states can earn interest on their net balance of certain crypto coins.

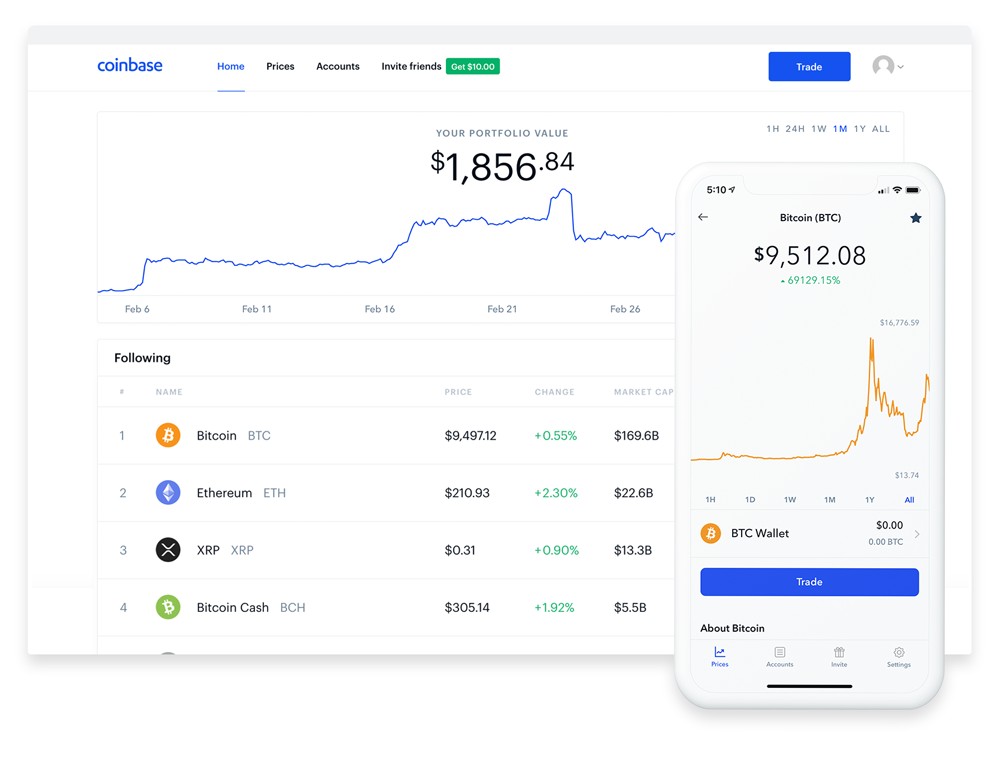

But, each exchange offers some unique features. You’ll also get a digital hot wallet with Gemini and Coinbase and a pleasant number of informational resources. $1,000 day by day for debit card purchases.Įach platforms are suitable for beginner users, with straightforward user interfaces (UI), user-friendly mobile apps, and straightforward trading options. $5,000 day by day and $30,000 a month for deposits and $100,000 day by day for withdrawals via ACH. Two-step verification, FDIC-insured USD balances as much as $250,000, cold storage, AES-256 digital wallet encryption, multi-signature wallets, and cold storageīuy, sell, exchange, send, withdraw, and receive Two-step verification, FDIC-insured USD balances as much as $250,000, Gemini Wallet digital insurance, U2F security with a hardware key, and cold storage User-friendly platform designed for beginners, supports withdrawal to PayPal, and ways to earn cryptoįixed fee for trades under $200 or 1.49% for trades over $200, 3.49% debit or bank card purchaseĠ.50% per trade, 3.99% for bank card purchases, and 1.49% for Coinbase wallet or checking account purchases Rain Financial Inc, a top exchange in UAE fired a significant part of its workforce, blaming the economic slowdown.Beginner-friendly and secure interface, multiple buying and selling options, and skill to earn interest on stored crypto Despite positioning itself as an oasis for crypto companies across the world, crypto exchanges in Dubai and UAE are also going through tough times. This ‘firing frenzy’ has not left the Middle East untouched. Moreover, crypto exchanges like Mercado Bitcoin and Bitso laid off over 10 per cent of their employees to beat the economic woes. The twins announced in a blog post earlier this month that the crypto industry is in a “contraction phase” and this downtime has been “further compounded by the current macroeconomic and geopolitical turmoil.”Ĭryptocurrency trading platforms like BitMEX and Robinhood also recently reduced their headcount in the past few months, blaming the global economic downtrend.Īlthough crypto exchanges such as Binance and FTX seem to have openings, those positions are only available in new geographical areas and untapped markets where they are establishing their operations.Ĭrypto exchanges in Latin America, which has the most amount of active crypto users as per data from Statista, are also facing the brunt of the weak global economic cues and are partaking in this ‘firing fever’.Īrgentinian crypto exchange, Buenbit laid off 45 per cent of its employees. Gemini crypto exchange, which is run by the Winklevoss’ twins, also cut 10 per cent of its staff and justified this by claiming that the crypto winter is here.

0 kommentar(er)

0 kommentar(er)